Natural resources and corruption: Is democracy the "missing link"?

De FUNDACION ICBC | Biblioteca Virtual

Sambit Bhattacharyya y Roland Hodler, VOXEU, 13 de noviembre de 2009 (texto en inglés)

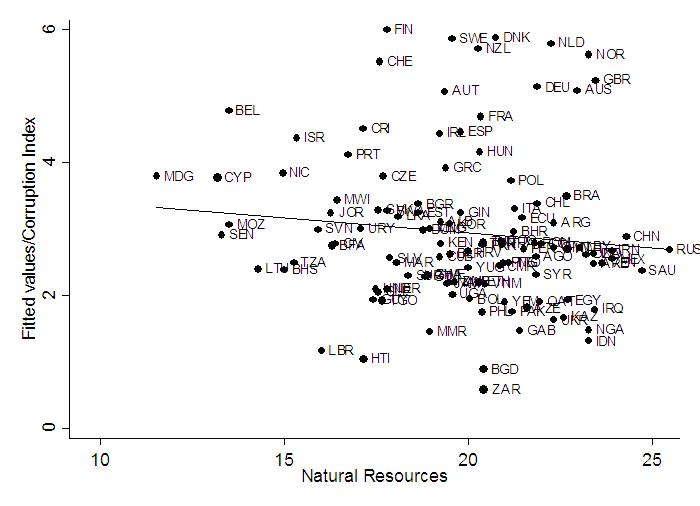

Natural resources are often associated with high levels of corruption. Nigeria and Bolivia are perhaps the most cited examples of this association. Figure 1 plots log resource rent as a measure of natural resources in 1990 against the Political Risk Service's corruption index in 1990, demonstrating that more corrupt (lower index value) countries tend to have more natural resources.

Figure 1. Corruption and natural resources

In the past, economists have studied this issue both empirically and theoretically. One main argument put forward was that resource rents and rents induced by a lack of product market competition foster bureaucratic corruption (Ades and Di Tella, 1999). Others have argued that resource extraction itself is a rent-seeking activity that encourages rent seeking in other sectors of the economy and limits growth (Leite and Weidman, 2002). Empirically several studies have shown that the proportion of exports of fuel, minerals, plantation crops, and metals increases corruption (Treisman, 2000; Isham et al., 2005; and Aslaksen, 2007). However, it still remains a puzzle why some resource-rich countries (for example Australia, Canada, Norway) have very low levels of corruption. The answer to the key question of how natural resources affect corruption also remains uncertain.

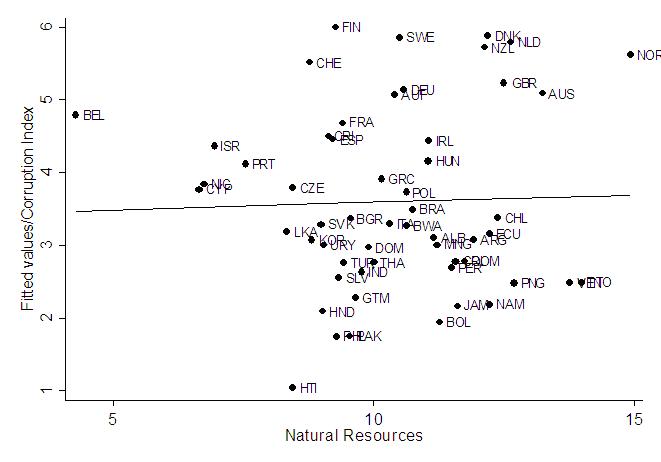

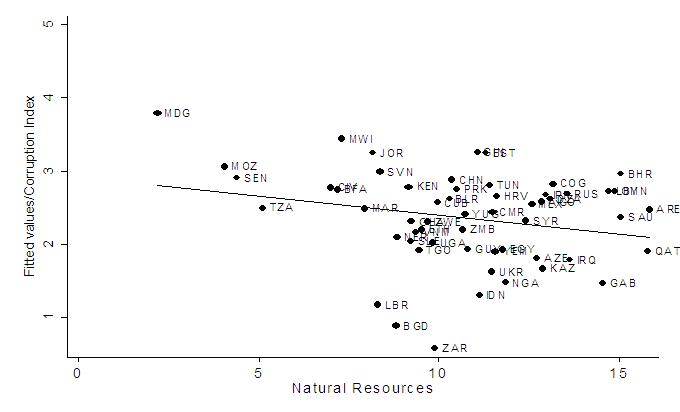

In this column, we make an attempt to provide an answer to this puzzle. We argue that strong democratic institutions help to moderate the effect of natural resources on corruption. A brief look at the data already provides some support for this prediction. In Figures 2 and 3, we split the sample into democratic and non-democratic countries.1 These suggest that the negative relationship between natural resources and the corruption index prevails in the sample of non-democratic countries but not in the sample of democratic countries.

Figure 2. Corruption and natural resources, democracies

Figure 3. Corruption and natural resources, non-democracies

In a forthcoming paper (Bhattacharyya and Hodler, 2009), we provide more systematic and rigorous empirical test of this prediction using a reduced-form model and panel data covering the period 1980 to 2004 and 124 countries. The estimates confirm that the relationship between natural resource rent and corruption depends on the quality of the democratic institutions. In particular, we find that resource rents are positively associated with corruption in countries for which the net democracy score POLITY2 is 8.5 or less. In 2004, the resource-rich countries Bolivia and Mexico had a POLITY2 score of 8, and resource-rich Botswana a POLITY2 score of 9. Our estimates predict that if resource rents in Angola (a resource-rich country with POLITY2 score of -3) declined from approximately $1.5 million to zero, its corruption would fall by 1.5 points of the Political Risk Services’ corruption scale. That is equivalent to one sample standard deviation in our 124-country sample, and the decline would be even greater if Angola’s democratic institutions matched the quality of Botswana’s. These results hold when we control for the effects of income, time-varying common shocks, regional fixed effects, and various additional covariates. It is also robust to various alternative measures of natural resources, corruption, and the quality of the democratic institutions, as well as across different samples.

How does democracy mediate resource rents?

The key question is how to explain this evidence. In our paper, we present a political economy model to illustrate how democracy might affect the relationship between resource rents and corruption. We construct a game between politicians and the people. We assume that there are some “good” politicians who act in the people’s best interest and possibly many more “bad” politicians who primarily care about the revenues they can generate by corrupt activities. The mass prefers to have a good politician as their president. This provides an incentive for a bad incumbent president to mimic a good president and not to engage in corruption in order to maximise his chances of remaining in power. In equilibrium, a bad incumbent mimics a good incumbent if and only if the democratic institutions are sufficiently sound, i.e., if and only if popular support significantly improves his probability of staying in office. If this difference is small, a bad incumbent engages in corrupt activities. The level of corruption in this case increases with natural resources, as resource rents are less sensitive to corruption than other sectors of the economy. Therefore, resource abundance increases corruption in countries with poor democratic institutions but not in countries with comparatively better democratic institutions.

Policy lessons

These findings imply that resource-rich countries have a tendency to be corrupt, because resource windfalls encourage their governments to engage in rent seeking. However, history shows that countries discovering natural resources after they have established well-functioning democratic institutions tend to handle the scourge of corruption much better. Australia, Canada and Norway are good examples of this trend. The converse is not difficult to find, of course.

The evidence here suggests that this tendency can be checked by sound democratic institutions that keep governments accountable. Such institutional changes would include both electoral and judicial reforms. Promoting citizens’ right to information through legislation, increasing community participation, and social auditing of bureaucrats can also be important tools towards building a more accountable government. Even though far from conclusive, some country studies are already showing corruption-reducing effects of such policy changes (Bhattacharyya and Jha, 2009; Olken, 2007).

Footnotes 1) Countries are considered democratic if their POLITY2 score is above 0 in 1990.

References

- Ades, A., and R. Di Tella. (1999). “Rents, Competition, and Corruption,” American Economic Review, 89(4), 982-993.

- Aslaksen, S. (2007). “Corruption and Oil: Evidence from Panel Data,” mimeograph.

- Bhattacharyya, S., and R. Hodler (2009). “Natural Resources, Democracy and Corruption,” European Economic Review, forthcoming.

- Bhattacharyya, S., and R. Jha (2009). “Economic Growth, Law and Corruption: Evidence from India,” Unpublished Manuscript.

- Isham, J., L. Pritchett, M. Woolcock, and G. Busby. (2005). “The Varieties of Resource Experience: Natural Resource Export Structures and the Political Economy of Economic Growth,” World Bank Economic Review, 19, 141-174.

- Leite, C., and J. Weidmann. (1999). “Does Mother Nature Corrupt? Natural Resources, Corruption and Economic Growth,” IMF Working Paper No. WP/99/85.

- Olken, B. (2007). “Monitoring Corruption: Evidence from a Field Experiment in Indonesia,” Journal of Political Economy, 115(2), 200-249.

- Treisman, D. (2000). “The Causes of Corruption: A Cross-National Study,” Journal of Public Economics, 76, 399 – 457.