Foreign firms and firm survival: a look at Ireland in crisis

De FUNDACION ICBC | Biblioteca Virtual

Olivier N. Godart, Holger Görg and Aoife Hanley, VOXEU, 21 February 2012

When disaster strikes, what happens to foreign firms? Do they move away, leaving an already unstable economy even further off balance? Or do they sit on their sunk costs and help steady the ship? This column looks at data from Ireland during the recent financial turmoil.

Is it a good idea for countries to rely heavily on foreign multinationals in their industrial structure? Or does it perhaps introduce further instability into an economy when there is a negative shock? Recent developments in the Irish economy allow us to shed some light on this question.

While Ireland is undoubtedly in dire financial straits, the real side of the economy – and here, in particular, export activity – is doing quite well. Exports are not only growing in manufacturing, but also in the services sector (FDI Intelligence 2010). One important aspect of Irish industry is, of course, that a large share of productive activity and exports in both manufacturing and services is generated by affiliates of foreign multinationals located in Ireland.(1)

One school of thought argues that such a heavy reliance on foreign multinationals may introduce an unstable element into the economy, as multinationals may be inherently more ‘footloose’ than indigenous firms (Flamm 1984, Cowling and Sugden 1999). Foreign firms are less embedded into local economies and therefore better positioned to shut down operations when faced with falling aggregate demand in the host economy. An opposite argument highlights the importance of sunk costs. Since setting up a business abroad involves substantial unrecoverable set up costs and investments, foreign firms may bring more stability. As pointed out by Baldwin (1988) and Dixit (1989), large sunk costs imply that once firms exit a market, they may find it difficult to re-enter in the future. Hence, they may not leave easily when the economy is hit by a negative shock, but rather stay put.

Our recent work looks at evidence from the Irish economy in crisis (Godart et al. 2011). We look at firm survival during a crisis and, in particular, the difference between foreign and domestic firms. We use firm-level data that cover manufacturing and services sectors from the Amadeus database for Ireland before and during the crisis from 2006 to 2009. We measure the firms’ overall economic fragility in terms of its likelihood of closing down, controlling for other factors such as firm size which likewise have an impact on a firm’s health.

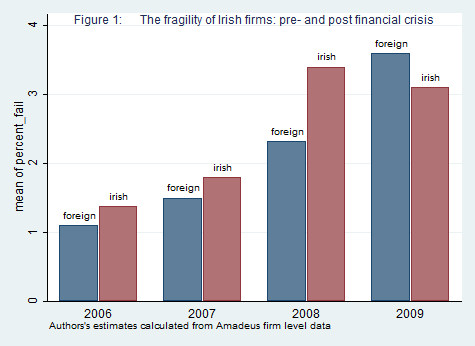

What do we know about the state of firms in Ireland during our four-year window? There are clear differences in the pre-crisis (2006-2007) and post-crisis (2008-2009) periods. Figure 1 shows the aggregate probability of firm exit, calculated as the number of exits relative to all firms. Average firm closure rates increased steeply by 104% and 127% for Irish and foreign firms, respectively. There are, however, marked differences in the resilience of Irish domestic and foreign firms once the crisis starts to bite. In 2008, arguably the start of the crisis with the collapse of Lehman’s Brothers, the aggregate incidence of foreign firm failure was 32 percentage points beneath that of Irish firms. By 2009, as the crisis began to take its toll, the edge of foreign over Irish firms seemed to quickly evaporate. Of course, a simple figure showing changes in the stock of manufacturing firms fails to consider other influences such as the concentration of foreign firms in high-tech sectors like instrumentation and chemicals, or other factors such as the age of firms or their size.

Figure 1 The fragility of Irish firms: Pre- and post-financial crisis

Our analysis then goes one step further and models empirically the probability of closure at the firm level as a function not only of the relevant firm-level variables (age, size, foreign ownership, and industry), but also including the impact of the crisis. This is done in a difference-in-differences framework where we compare the incidence of firm exit before and after the crisis set in, and allow for differences between domestic and foreign firms. Hence, the assumption is that any changes caused by the crisis (e.g. changes in local demand) affect firms in the same industry and nationality group in a similar way. We estimate hazard models of firm exit applied to Irish firms from 2006 to 2009, and this is estimated separately for firms in manufacturing and services sectors.

We summarise the results obtained from the regression analysis in Table 1. We focus on the impact of the three main variables, namely, whether or not a firm is foreign owned, the post-crisis period, and the interaction of the two (i.e., the difference-in-differences estimate). The results are presented for both manufacturing and services sectors.

One striking fact is that the crisis has hurt firms in all sectors of the economy, but to a higher degree in the service sector than in manufacturing, as shown by an increase of the closure probability by around 60% in the services sector and 35% for manufacturing after the crisis started in 2008. This may be partly due to the fact that services rely to a much larger extent on domestic demand. Also, the relative robustness of manufacturing is likely a consequence of the sequencing of the problems caused by the crisis. Those first in line to close down were firms that rely heavily on the banking, investment, and real-estate sectors. Manufacturing being one step removed from the immediate effects of the crisis, its decline is more likely to be caused by the knock-on drop in consumer spending and confidence on the domestic and export markets.

Concerning differences between foreign and Irish firms, we see that, shortly before the crisis, foreign services firms were around 50% less likely to close than Irish-owned firms. During the crisis, this survival premium gets completely wiped out where foreign services firms were now seen to be around 50% more likely to shut down than their Irish counterparts. Our empirical analysis adds, however, that there is no observed difference between foreign and domestic firms in manufacturing.

Table 1 Change in shut-down probabilities from hazard model Firms active in: Manufacturing Services

Firm is foreign owned ↓49.7%

Impact of crisis ↑34.5% ↑59.3%

Impact of crisis if a foreign firm ↑48.3%

Notes: Probabilities only reported where the relationship is statistically significant. We control for firm size, age and two-digit industry in the hazard model.

We interpret our analysis as showing that foreign multinationals do not introduce more instability into the economy in times of the financial crisis. This should provide some reassurance to other countries that also rely on foreign affiliates in the development of their industrial structure.

References

- Baldwin, R (1988), “Hysteresis in import prices: The beachhead effect”, American Economic Review, 78:773-785.

- Cowling, K and R Sugden (1999), “The Wealth of Localities, Regions and Nations: Developing Multinational Economies”, New Political Economy, 4:361-378.

- Dixit, A (1989), “Entry and exit decisions under uncertainty”, Journal of Political Economy, 97:620-638.

- FDI Intelligence (2010), “Ireland Suffers Sharp Fall in Inward Investment in 2009 Though Still Punches Above Weight”.

- Flamm, K (1984), “The Volatility of Offshore Investment”, Journal of Development Economics, 16:231-248.

- Godart, O, H Görg, and A Hanley (2011), “Surviving the crisis: Foreign multinationals vs domestic firms in Ireland”, CEPR Discussion Paper 8596.

(1) Indeed, the perceived need to maintain Ireland as an attractive venue for foreign direct investment thereby avoiding a large drop in exports, is one reason for the increasingly vocal battle to maintain Ireland’s highly competitive corporation tax rate relative to other EU member states.