Leading with services: The dynamics of transatlantic negotiations in services

De FUNDACION ICBC | Biblioteca Virtual

Patrick A. Messerlin y Erik van der Marel, VOX, 31 de julio de 2009

Services providers are busy redesigning their strategies for coping with the ongoing economic crisis. To take the appropriate decisions, they need predictable future market access in services. Meanwhile, as many services are still highly protected, opening services markets would deliver large benefits to consumers impoverished by the crisis.

Thus, starting trade negotiations on services now seems the right thing to do. But, how to do so when such negotiations are notoriously difficult? Here we explore the dynamics of a pragmatic approach that, if successful, could be used as a jump-start of the Doha Round.

As a first step, the US and the EC would launch transatlantic negotiations in services. For these two largest world economies, the output of the services that can be confidently defined as substantially protected is larger than their respective agricultural and manufacturing sector – opening the possibility of vast opportunities to firms and huge gains to consumers.

Would such negotiations be attractive for both sides of the Atlantic? Yes, but for different reasons. US services providers are on average less protected than EC services, so the US has clear interests in such talks – a feature that should reverse the current negative mood of the US Congress on trade matters. Being less open, EC services providers may seem less sanguine to negotiate, whereas EC consumers would be the main beneficiaries from successful talks. However, the picture is more complex. The EC may use transatlantic negotiations as a way to deepen its own internal market – as it did for industrial goods in the 1960s with the Kennedy Round. As applied regulatory restrictions across EC member states vary widely among every service, the level of restrictions that the EC bound at the Uruguay Round is (much) higher than the level currently applied by most member states.

Opening the markets of the most protectionist EC member states (often large) for a service would thus create opportunities for services providers from the US and from the other (less protected) EC member states – meaning that many EC services providers would support Transatlantic talks in services.

It remains that such a first step is fragile for two reasons. First, bilateral trade deals are hard to conclude and ratify, as amply shown these days. Second, economic analysis warns that such deals can be costly for the negotiating partners as they distort trade and investment flows. There is no reason to believe that transatlantic negotiations in services would be immune to such pitfalls.

Going plurilateral

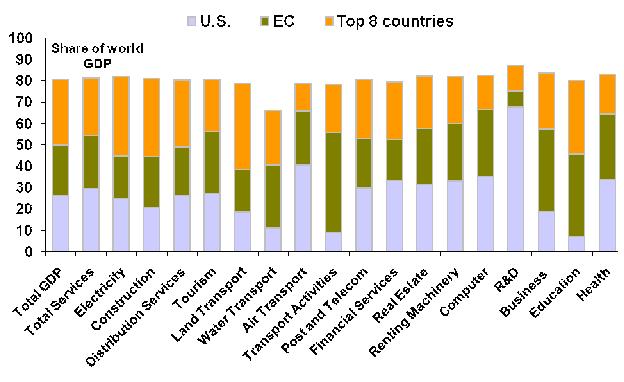

Hence, the following second step. Once the EC-US talks are on track, it would be relatively costless and highly beneficial to extend them to (roughly) eight other countries – a group small enough to keep negotiations manageable and large enough to ensure that more than 80% of world services output are covered in the negotiations, as illustrated by Figure 1. These eight countries include all the key emerging countries, and all of them are members of the G20.

Figure 1. Going plurilateral: How many countries make a critical mass?

Source: Messerlin and van der Marel (2009).

Source: Messerlin and van der Marel (2009).

How attractive would be this second step for all the potential participants? For the US, a shift from bilateral to plurilateral negotiations would double the size of the deal and likely double its expected benefits. For the EC, it would allow it to open markets that, together, are often as large as the EC’s markets and as protected as the most protected EC member states. For the eight additional countries, they would enjoy, mutatis mutandis, the same gains as the EC (huge gains for their own consumers, wide opportunities for their efficient service providers). And they have an additional key incentive; it would be costly not to join the EC-US talks since the US and the EC could then tailor international regulatory norms to their narrow interests – imposing high regulatory costs on latecomers.

Last, but not least, shifting from bilateral to plurilateral negotiations would considerably reduce the risks of major distortions in the world services markets. A successful outcome of such plurilateral talks could (and, in our view, should) ultimately be repatriated, implicitly or explicitly, into the Doha Round negotiations, giving the round the final boost that was missing in July 2008. In short, the dynamic forces pressing for shifting from bilateral to plurilateral negotiations seem powerful enough to justify the risk of starting by EC-U.S. bilateral talks.

Could it work?

Is there any appetite for services negotiations now? Yes. The July 2008 Signalling Conference held under the aegis of the Doha Round showed a substantial number of participants expressing strong interests in most services, offers and requests in mode 3 in many services (foreign direct investment), and even a willingness to include mode 4 (movement of natural persons, by far the most contentious part of any service negotiations) in some services.

Such a willingness to negotiate appears particularly strong in three services: business, communication, and distribution services. Together, these three services in the EC, US, and top eight countries represent almost one-third of the world GDP, a size so huge that negotiators could work on deals within as well as between these services sectors. The three services face high levels of regulatory constraints, ensuring huge economic gains in case of market opening. Finally, negotiations are made easier by the fact that business and communication services are resilient to the current crisis, while the inflationist pressures to come should make governments eager to have distribution services as competitive as possible.

Last but not least, the foreign policy dimension of the whole endeavour is crucial for Europe. Many US decision-makers are looking to Asia for good reasons (Bergsten, 2009) while Europeans have not yet fully grasped the growing importance of Asia nor captured its attention, as illustrated by the disappointing June 2009 Asia Europe Ministerial meeting on energy. If transpacific talks in agriculture and manufacturing have some (limited) attraction to the US (exporters of agriculture) and Asian economies (exporters of industrial goods), there is no equivalent for the EC. In such a context, opening transatlantic negotiations in services would help Europe keep the US looking east, induce Asia to look west, and give itself its full importance.

References Bergsten, F. (2009) “Obama needs to be bold on trade” June 23, Financial Times.

Messerlin, P. and E. van der Marel (2009) “Leading with Services: The Dynamics of Transatlantic Negotiations in Services” June. GEM Policy Brief.