Buying land in developing nations: Challenges and promises

De FUNDACION ICBC | Biblioteca Virtual

Denis Drechsler y David Hallam, VOX, 29 de junio de 2009

Foreign acquisitions of farmland in Africa and elsewhere have become a cause of concern. Many observers consider this development a new form of colonialism that threatens food security of the poor (Economist 2009). However, such investments could be good news if the objectives of land purchasers are reconciled with the investment needs of developing countries.

Alarming capital gaps

The agricultural sector in developing countries is in urgent need of capital. Decades of low investment have meant stagnating productivity and production levels. In order to halve the world’s hungry by 2015, as targeted by the Millennium Development Goals, FAO calculations show that at least $30 billion of additional funds are required annually. A complete eradication of hunger by 2050 is estimated to cost an additional $90-100 billion each year.

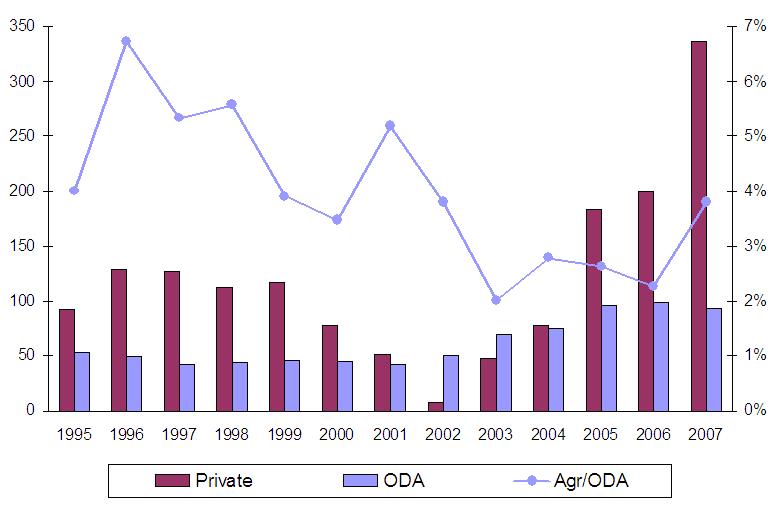

Developing countries’ capacity to fill these gaps is limited and official development assistance is no real alternative (see Figure 1). In fact, the share of aid going to agriculture has trended downwards to below 5%. The question is not whether international investments should provide a supplement to other capital inflows, but how their impact can be optimised.

Figure 1. Capital flows to developing countries, billions USD

Source: OECD, Creditor Reporting System, 2009.

What do we know?

Information about international investments in agriculture is scarce and mostly based on anecdotal evidence. From what limited information is available (see Box 1), three observations stand out:

international investments into agriculture have increased, but land under foreign control remains a small portion in developing countries; though investments are mostly private, governments are heavily involved, especially in recipient countries; and the focus of investments has shifted from cash crops to the production of basic foods.

Key facts of international investments in agriculture

- Investments have increased - Deals seek access to resources, not markets - Main form of investment: land purchase or long-term lease - Share of total land assets owned by foreigners is small - Major investors: Gulf States, China, Republic of Korea - Main target region: Africa - Investors: mostly private sector, but governments involved - Investment partners in host countries: mainly governments - New focus: production of basic foods and animal feed

These observations hint at the driving forces behind the current wave of investments. Many deals are stimulated by food security concerns, especially those coming from wealthier countries with land and water constraints. High food prices and policy-induced supply shocks evidently created fears that dependence on world markets to satisfy domestic demand has become risky. It is doubtful, however, whether land acquisitions offer the best response to this challenge.

Seizing opportunities through partnerships

The sale of farmland to international investors is not without risk for developing countries. Experience shows that such sales can cause land expropriation or lead to an unsustainable use of resources, thereby undermining the livelihoods of local populations.

They also promise several opportunities, including a technology transfer to stimulate innovation and productivity increases, quality improvements, employment creation, and backward and forward linkages and multiplier effects through local sourcing of labour and other inputs. Even an increase in food supplies for the domestic market and for export is possible.

However, these benefits will not come automatically, and it will take efforts of both investors and recipients of investments to realise their full potential. Above all, it requires an understanding that collaboration promises mutual benefits.

Making investments work

Host countries hold the prime responsibility for attracting investments to where strategic needs are greatest and ensuring that these needs are met. Many land deals seem to have been settled between investors and host governments with little concern for whether benefits would trickle down to the local population. Insufficient documentation of smallholders’ rights prevented them from making any claims. While much land in developing countries is currently not fully utilised, apparently “surplus” land does not mean that it is unused or unoccupied. Better systems to recognise land rights are thus urgently needed. Similarly, governments should try to avoid investments that create enclaves of advanced agriculture detached from local realities. These will do little to improve smallholder production or generate additional incomes and employment opportunities.

International investors are equally called to action. They should recognise the local consequences of their investments and consider labour, social, and environmental standards, stakeholder involvement, and food security concerns – not because they are obliged to do so, but because it serves their own self-interest. Madagascar is a case in point. Public unrest stopped a deal after it became known that the government tried to sell off 1.3 million hectares of land to South Korean investors. Similar events prevented investments in Indonesia (500 thousand hectares to Saudi Arabian investors) and the Philippines (1.2 million hectares to China). More inclusive strategies would have offered a solution.

Exploring alternative strategies

Apart from improving the conditions of land deals, several looser contractual arrangements should also be considered. In fact, the purchase and direct use of land resources is only one strategic response to the food security problems of countries with limited land and water. A variety of other mechanisms can offer just as much – or even higher – security of supply, such as contract farming and out-grower schemes, bilateral agreements including counter-trade, and improvement of international food market information systems.

Investment could be in much-needed infrastructure and institutions that currently constrain agriculture in developing countries, especially in Sub-Saharan Africa. This, together with efforts to improve the efficiency and reliability of world markets as sources of food could raise food security for all concerned through an expansion of production and trade possibilities.

Ways forward

The risks attached to international investments have led to calls for a binding code of conduct. While its enforcement is likely to be problematic, it might nevertheless offer a framework to which national regulations could refer, especially if parties realise that compliance with common standards is in their mutual self interest.

More importantly, international investments in agriculture other than land acquisition should be evaluated and promoted. To this end, the extent, nature, and impact of international investments going to developing countries needs to be better understood and monitored. Best practices should be catalogued in law and policy to better inform both host and investing countries. An international experts meeting, to be organised by FAO in July of 2009, will offer important insights in this regard.

Authors' note: This column is based on an FAO Policy Brief.

References

The Economist (2009), “Buying farmland abroad - Outsourcing's third wave”, 21 May.

FAO Social and Economic Perspectives (2009), From Land Grab to Win-Win – Seizing the Opportunities of International Investments in Agriculture, Policy Brief No.4, Rome.

Hallam, D. (2009), International Investments in Agricultural Production, prepared for the FAO Conference on “How to Feed the World in 2050?”, FAO, IFAD and IIED (2009), Land Grab or Development Opportunity? Agricultural Investment and International Land Deals in Africa.